Write-up and Re-watch: The Future of Mortgages 21/10

On Thursday 21st October the Northern FinTech community came together virtually to discuss and explore how FinTech is impacting the Mortgage sector and the road to home ownership.

The Future of Mortgages was hosted in partnership with AI and ML specialists Sandstone Technology. The community were clearly looking forward to this event, with nearly 200 registrations for the event.

For those who were unable to join the session live, we have produced a write-up and recording. Click the image below to view the recording, and scroll down to read our write-up.

Joe Roche, Engagement Manager at FinTech North, welcomed attendees and provided an overview of FinTech in the North and spoke about the work FinTech North does in the ecosystem.

Holly Webster, UK Marketing Manager at Sandstone Technology, welcomed attendees on behalf of our event partners and provided an overview of their services as a leading provider of technology to the banking and FinTech sectors.

Julian Wells, Director at Whitecap Consulting and FinTech North, was our next speaker. Julian provided a quick overview of the sector, walking through the most recent FCA & Bank of England industry stats:

- Lending has recovered and is growing steadily – it was 2 ½ times higher in Q2 this year than it was in 2020

- Re-mortgage market is very subdued at 16% of gross advances, the lowest since records began in 2007

- Home mover market is the most buoyant space, although product transfers would also be showing an upward trend

- High loans to value lending is increasingly slowly, but still lower than 2020 levels

- An upturn in arrears isn’t evident still, and arrears are currently the lowest since Q2 2020

- Expectation that arrears will be trending upwards over the coming months, with Covid support measures being removed and an interest rise increasingly likely

Julian then introduced Maria Harris. Maria is Director of Digital Cat Consultancy, is well embedded in the UK Mortgage market and was part of the Atom Bank team who delivered the world’s first digital mortgage.

Key trends as Maria sees them:

- Volumes are up, the mortgage market is running crazy

- Mortgage pricing is competitive, good news for customers, fantastic rates – this creates huge margin pressure for lenders – creating tension in the market

- There’s a real push to update systems, move to digital, take the pain out of the process

- Some of this is driven by covid, making the broker and customer experience better

- Interest rate rise could take some pressure off the banks and BS lenders

- Unknowns:

- Arrears still low, we thought this would tick up

- We’ve had an artificial situation keeping the market buoyant

- Energy rates are peaking

- Lenders could be jittery

- Unprecedented; this hasn’t happened before and we don’t have any data to see what this will look like

- Industry movement towards ecosystem and trust frame works – getting data part of what we do day to day,

- Real traction with people joining system together

- Industry and govt working together

- First live mortgage transaction on DLT!

- Crypto-coin for completion – Aspiring homeowners to-be will no longer have to wait for their keys on the drive in the moving van. How this works:

- At the point where everyone is signed and completion date set

- Rather than transfer all the money, we just need to verify that bank A and person A have the money

- Overnight reconciliation process happens overnight automatically

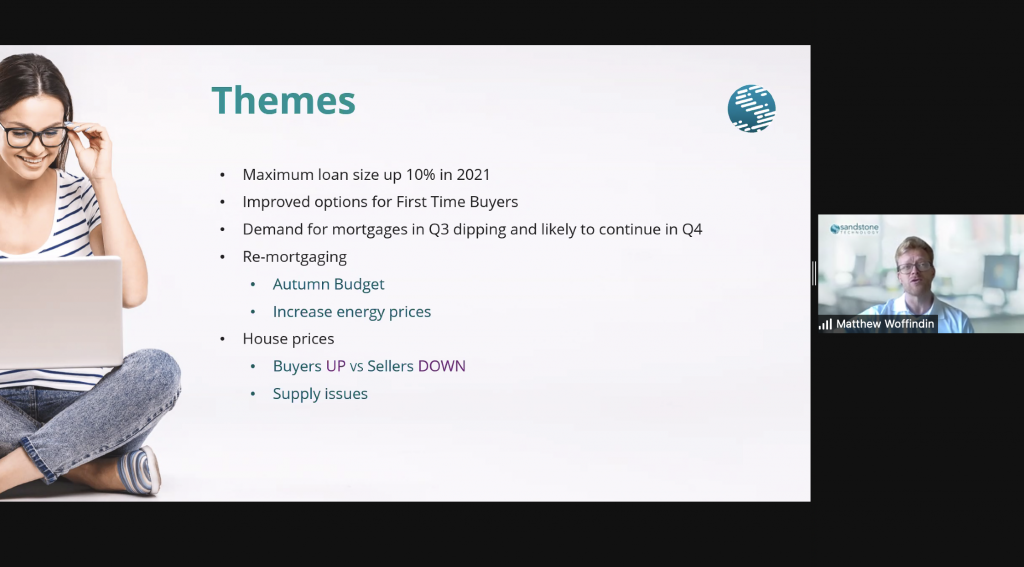

Next up on the virtual stage was Matt Woffindin, Head of UK Sales at Sandstone Technology. Matt provided an insight into market dynamics from Sandstone’s perspective as a technology provider to banks:

- Buyers up, sellers down

- Max loan size up 10%

- In-branch challenges:

- 4k bank and building society branches have closed in the last 6 years – 50 a month

- FCA – average cost of running a branch = 590k per year

- 90% of all customer contact for HSBC is over the phone

- 121 customer support is always needed, particularly with vulnerable customers

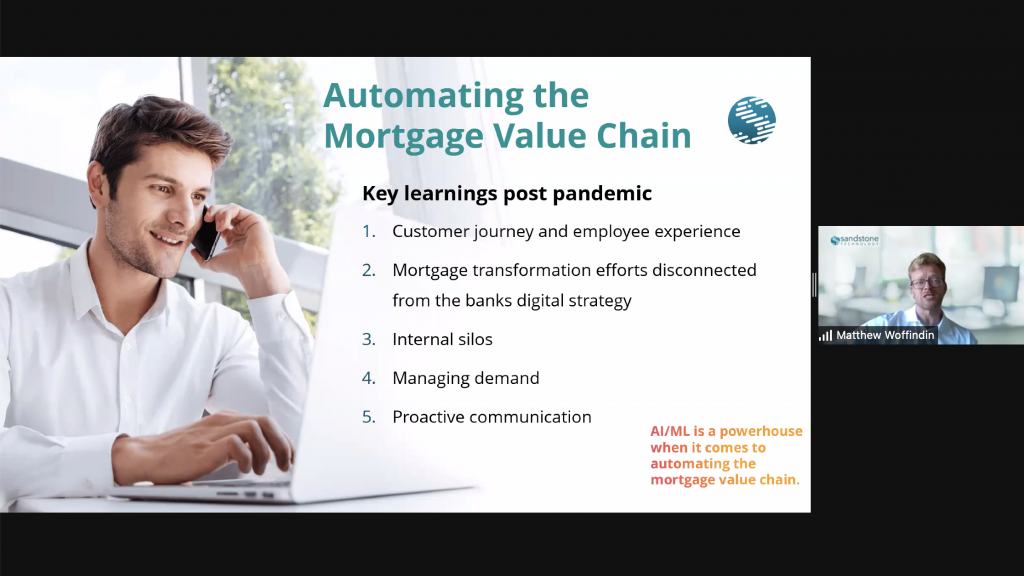

Automating the mortgage value chain:

- Customer journey and employee experience

- Mortgage transformation efforts disconnected from banks digital strategy

- Internal silos

- Managing demand

- Proactive communication

“Processing a loan shouldn’t be a painful process” – Matt Woffindin, Head of UK Sales, Sandstone Technology

Rahim Saddique, Senior Business Analyst, then joined Matt on the virtual stage to talk about the technology underpinning some of the market dynamics we’re seeing.

“Initial collection of data is one of the most time consuming processes – incredibly inefficient and event chaotic” – Rahim Saddique, Senior Business Analyst, Sandstone Technology

Today’s business problems (within the Mortgage process):

- Digital channels uploading documents 24/7

- Customers expect real-time processing

- Unable to process large volumes of documents efficiently

- Verification errors cause rework and regulatory issues

- Processing docs slows application times

- Cross checking docs manually difficult and time consuming

- Manual effort constrains growth

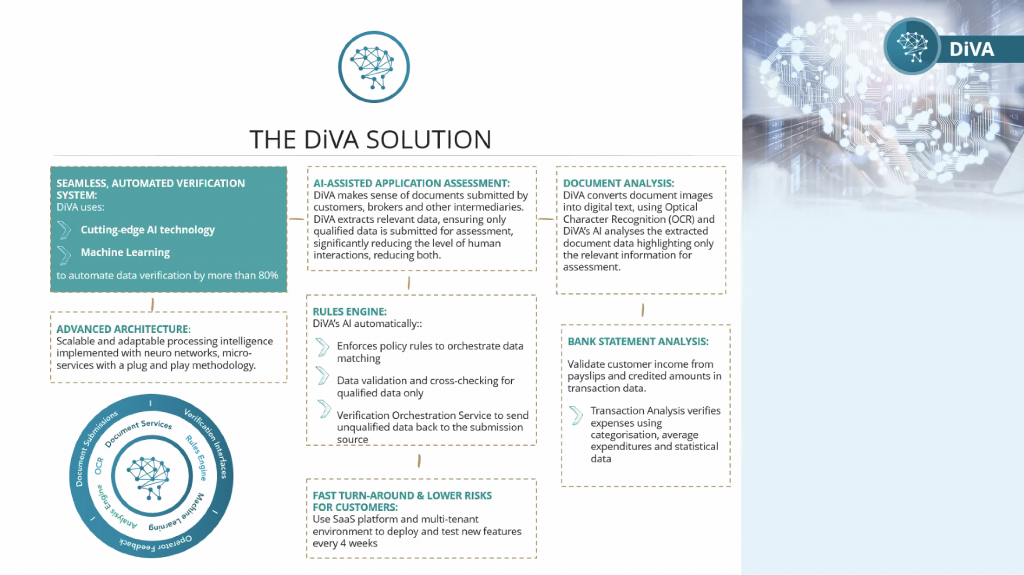

Rahim then spoke about Sandstone’s AI enabled DiVA Solution. Diva uses AI and ML to provide an automated, seamless verification system.

Diva:

- Digests and processes large volumes of data from various sources; brokers, customers and intermediaries can upload documents and verify data.

- Diva can classify documents and knows the difference between a phone bill and a utility bill.

- Only qualified data is submitted for assessment; data coming through Diva is clean.

- Diva reduces the human interaction, however a more manual approach can also be accommodated.

- Can validate customer income or expenses.

To reach out to Holly, Rahim or Matt at Sandstone, please contact – please email info@sandstone-tech.com or visit https://www.sandstone.com.au/en-gb/en-gb/fintechnorth

Mortgage Innovators Panel:

We then gathered our speakers all together for an interactive audience Q&A and panel discussion. At this point, we also introduced several new speakers to the event. We welcomed Karina Hutchins, Head of Mortgages at OpenMoney, Matthew Elliott, Co-founder at Nivo and Gary Woodhead, CEO and co-founder at Curveblock, to the discussion.

“It’s exciting to see transformation at a blistering pace… here are key questions as we see them

- How do you get customers to engage with these new systems and processes?

- How do you share and collaborate that information?

- How do you make sure the information shared is secure and protected against threats?

- How do you handle referrals, exceptions, where two cases are rarely ever the same?

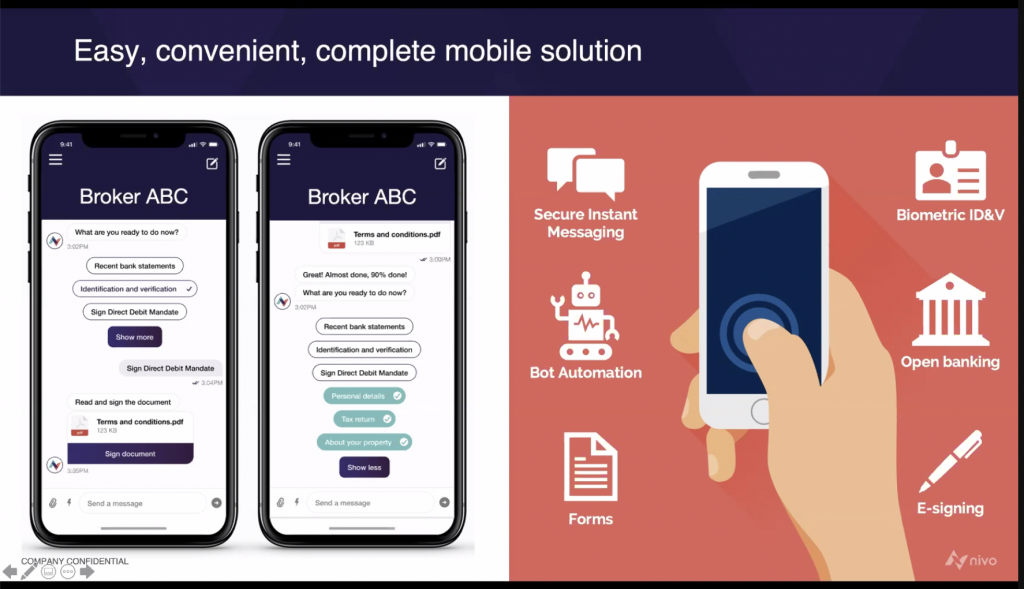

Nivo is a secure communications network specifically built to address these questions.” – Matthew Elliott, Co-founder at Nivo

“Most of our customers were saving for their first home. So it felt natural to move into the Mortgage space. Our service gives customers advice on everything they need to buy their first home. Everything they receive is in an online web portal.

Behind this sits a lot of integrations and logic… We’ve built a tool that uses customer data to suggest the maximum they spend on their mortgage – they can slide through different payments and see what age they will be at the end of their mortgage.” – Karina Hutchins, Head of Mortgages at OpenMoney

“We’re democratising real estate investment via blockchain to build houses that actually produce more green energy than they consume.

Problem: many first time buyers can’t afford a deposit to get onto the market.

There’s no reason why mortgage lenders can’t securitise the renewable energy.

Our houses provide energy to the home-owner, and allow surplus sold back to the grid = a good solution for the planet and getting millennials onto the ladder.

The cherry on the cake for providers; every mortgage issued = 57.5tons of CO2 removed from atmosphere, equivalent to 345 trees.

We’re about to execute under the FCA umbrella – this is the first time we’ve spoken about this to the public; hoping it brings interest and leads to exploratory conversations with mortgage providers.” – Gary Woodhead, CEO and co-founder, Curveblock

Panel Discussion:

“The biggest threat to providers are FinTechs. When we start using AI, ML and OpenBanking data properly, we won’t need to go to a mortgage provider, they’ll come to the customer. Customers won’t need to speak to anyone anymore, they go through a really nice journey with great Ux.” Maria Harris, Director of Digital Cat Consultancy

“Embrace these new technologies, lean towards rapid experimentation and put the building blocks in place for the future before it gets here.” – Matthew Elliott, Co-founder at Nivo

“Echoing what Maria and Matt have said, there’s been a shift especially during the pandemic, many brokers were quick to adapt, with lenders we saw huge delays in processing applications

We’re only operating in the first time buyer space, but we’re doing research into the remortgaging space – there’s still a need for advice here, which comparison sites can’t fulfil.” – Karina Hutchins, Head of Mortgages at OpenMoney

“There’s a lot of interest in using Open banking data and API’s in the process. There’s an over-reliance on paper documents running alongside this, which is why we’ve developed Diva. Why give a bank statement if the bank can provide it directly to the company?” – Rahim Saddique, Senior Business Analyst, Sandstone Technology

“Now there’s a shift and lenders want to ensure the provenance of the source data – lender acceptance, big data players making it happen, I sense Q1 as a time where that will accelerate” – Matthew Elliott, Co-founder at Nivo

“Trust is the biggest thing in banking, it’s a regulated industry, the data has to be trusted – this is where trust frameworks come through, Open Banking was built on this. This is the concept for the Digital Identity framework, which DCMS goes live any day now.” – Maria Harris, Director of Digital Cat Consultancy

“We need to stop thinking about forms and documents, and start talking about data and connecting systems so data can talk to data” – Maria Harris, Director of Digital Cat Consultancy

“We have to continue pushing delivering the visions, and see the big players in the market make those pivots and be more open minded about what an asset is “ – Gary Woodhead, CEO and co-founder, Curveblock