Northern FinTech Summit Day 2- Money and Tech & Product Write-up

On the 2nd of October, the Northern FinTech community returned for day 2 of the Northern FinTech Summit, hosted in partnership with Barclays Eagle Labs, Aviva, Cyber Alchemy, and Lenvi. With thanks to our namebadge sponsors, Incuto, and our inward investment partners West Yorkshire Combined Authority, Invest Liverpool City Region, North East Combined Authority and MIDAS – Manchester’s Inward Investment Agency.

Click here to read about day 1 of the Summit.

Day 2 focussed on the key themes of ‘Money’ and ‘Tech & Product.’ The morning sessions focused on financial insights, featuring updates from central banks, national investment figures, and guidance for investors – from understanding the value of investing in diverse businesses to preparing for exits and tax considerations. In the afternoon, the focus shifted to technology and product innovation, with discussions on regulatory collaboration, AI as a key driver for the future, start-up innovation, cybersecurity, and the role of FinTech in creating positive social impact.

Joe Roche, General Manager at FinTech North, once again opened the morning by welcoming delegates and providing an update on the organisation’s recent activities and strategy. The Summit’s return for a second day – one of the community’s most-loved events – highlighted the ongoing momentum, interest, and strength of the FinTech sector across the North. Julian Wells, Director at Whitecap Consulting then provided a short welcome, briefly outlining the findings of their North of England FinTech report.

Following this, Chris Lunardi, Ecosystem Manager at Barclays Eagle Labs, offered a warm welcome on behalf of the venue and highlighted the range of support Eagle Labs provides to entrepreneurs.

Central Bank Updates

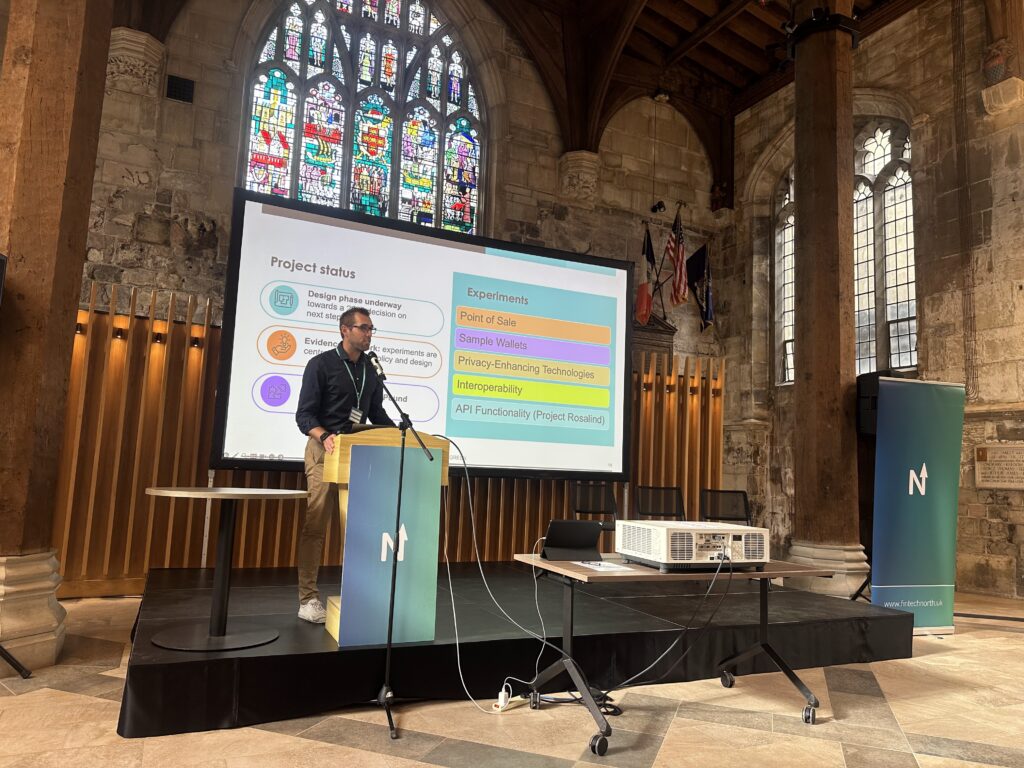

Kicking off the Money session, Danny Russell, Head of Digital Currency Technology at the Bank of England shared an update on their Digital Pound Lab, an experimental platform for industry to test use cases and understand potential business models for a digital pound. The lab aims to co-create use-cases with industry, understand potential business models, support innovation and support the Bank’s emerging thinking. He shared a call-to-action for FinTech to get involved, highlighting that Phase 2 applications are now open for proposals for innovative retail payments use-cases.

Further information on the Digital Pound lab, including its capabilities, terms of participation and how to apply can be found Digital Pound Lab | Bank of England.

Investment Landscape Overview

Next to the stage was Joshita Ganesan, Associate – FinTechs Membership, Client Management & Growth at Innovate Finance, who provided an overview of the UK FinTech Investment Landscape, including H1 2025 Insights & Trends.

Some key takeaways included:

-FinTech investment in H1 2025 globally and regionally is slightly up on H2 2024 – Investment levels appear to be stable.

-UK was flat on H2 2024

-UK falls to #3 place in Global Fintech investment, as the UAE moves into 2nd behind the US.

-UK remains #1 in Europe although the gap with the rest of Europe is narrowing.

She expanded on the Top 5 UK Fintech Deals in H1’25, capital pathways in IPO recovery and secondary market growth, and Innovate Finance members who raised capital in H1’ 25.

Gender Smart Investing

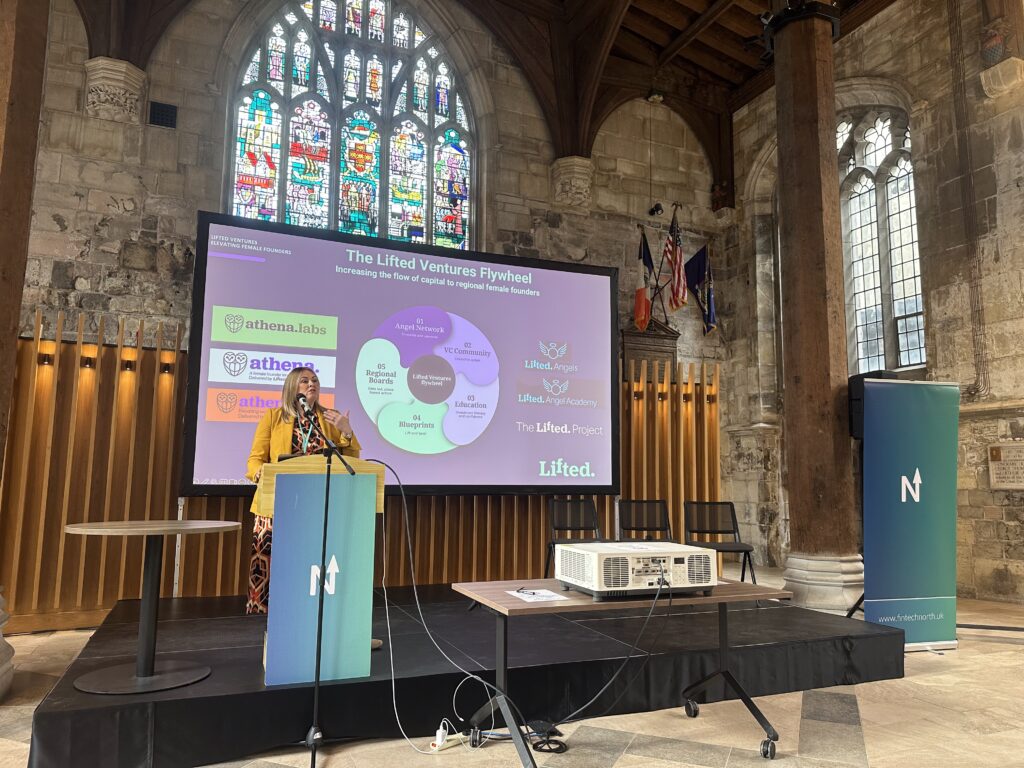

Jordan Dargue, Co-founder of Lifted Ventures, delivered a compelling session on how gender-smart investing can fuel the UK economy. She introduced Lifted Ventures’ ‘flywheel approach’ – combining investment, education, and community-building to support female founders – and shared impressive progress to date, including £11 million raised and several blueprints launched.

Jordan highlighted that gender-smart investing – which integrates gender diversity into investment decisions – can unlock new market opportunities, drive innovation, and create more resilient businesses. Despite female founders receiving only a small share of total VC funding, data shows they deliver stronger returns and faster exits. With growing momentum behind the Investing in Women Code and increasing investment in female-led ventures, Jordan emphasised the significant economic potential of closing the gender funding gap – estimated to add £250 billion to the UK economy.

She concluded with a call to action for investors and stakeholders to embrace inclusive funding practices and support gender-smart initiatives that drive both social and economic growth.

Investor Advice

The next session centred around Investor advice in becoming investor-ready. Moderated by Joshita Ganesan, Associate – FinTechs Membership, Client Management & Growth at Innovate Finance, the session brought together Ant Barker, Director of Venture Capital at Aviva, Ben Davies, Marketing Director at Praetura Ventures (soon to be PXN Group), and Johnnie Martin, Investor at Augmentum Fintech, to discuss what investors look for when funding a FinTech.

The conversation explored how investor priorities evolve with a company’s stage of growth. Founders were urged to focus on clarity of purpose, scalability, and a strong commercialisation pathway rather than trying to do everything at once. Ben highlighted the importance of answering ‘why you, why now,’ while Ant stressed strategic relevance, market opportunity, and team strength. Johnnie emphasised evidence-based growth, profitability, and tangible scalability.

Ant noted, ‘initiatives like the Mansion House Compact have huge potential to unlock new pools of domestic capital creating a real opportunity over the coming years for FinTechs looking for funding.’

The panel noted emerging investor interest in AI, consumer fintech products, and cross-border payments – while warning against leaning on buzzwords. They closed by encouraging founders to demonstrate resilience, conviction, and storytelling skills, underpinned by trust and sound financial understanding.

Northern Funding Success

Next to the stage was James Jackson, CEO and Co-founder of Bumper, who shared the company’s impressive growth journey – positioning Bumper as “the Klarna of car repairs.” Originating in London and now headquartered in Sheffield, Bumper has secured £30 million in investment to expand its team and scale operations. James outlined the company’s Buy Now, Pay Later proposition, which enables customers to approve critical car repairs through an embedded, interest-free checkout option that benefits both consumers and dealerships. He also highlighted the introduction of multiple payment methods – including Google Pay, Apple Pay, Open Banking, and in-store payments via the Bumper Pay Pad – alongside the Pay Longer product, offering extended payment terms with interest. The session showcased how strategic investment and innovation are driving Bumper’s mission to make car ownership more accessible and affordable across the UK.

Planning the Path to Exit

Continuing the ‘Money’ theme, the session on Planning the Path to Exit featured Gary Fenemore, Director at S&W, and Richard Carter, CEO of Lenvi, who shared practical insights on preparing a business for exit and long-term success. The discussion emphasised that an exit isn’t an endpoint but a transition — a baton passed on for the next stage of a company’s journey. Both speakers stressed the importance of having the right structures and share classes in place early, ensuring the business can be handed over in the best possible form.

They explored key considerations such as tax planning, share schemes to reward staff, and maintaining strong financial discipline — keeping “an eye on profitability and two eyes on cash.” Founders were encouraged to engage in early conversations about their runway, refine their pitching process, and understand their target market. The speakers also noted the UK’s generous investment tax regime and the importance of having a robust finance function to navigate complex strategic decisions. Their message was clear: successful exits are built on early preparation, clarity, and sound financial foundations.

The Future of Money

Closing the ‘Money’ session, Sofie Churchill, Enterprise Key Account Manager at Marqeta, shared insights from the organisation’s State of Payments Report – 2025. Sofie explored how digital wallets are evolving from tools that help users manage money to ‘financial brains’ that manage money on their behalf. She highlighted key trends shaping the future of finance – the shift from transactions to intelligence, the rise of platforms as interconnected financial ecosystems, and the emergence of programmable, AI-driven, real-time money. Her session offered a forward-looking perspective on how technology continues to redefine the way people and businesses interact with payments.

Innovation & Regulation

After the lunch networking session, delegates returned for the final session, focussed around tech & product innovation.

First to the stage was Colin Payne, Head of Innovation at FCA, who explored the opportunities emerging across the Northern fintech landscape, emphasising that ‘the next big thing could be born in the North.’ He discussed the power of embedding AI to drive efficiency and unlock new ways of serving consumers, underlining that progress depends on access to high-quality data. Colin spoke about balancing risk and opportunity, highlighting the FCA’s work to enhance the Digital Sandbox and its AI Supercharge Sandbox partnership with NVIDIA. He encouraged FinTechs to engage with these initiatives, stressing that trust, partnership, and collaboration are key to sustainable innovation and regional growth.

The Importance of Cyber Security Planning

In the following session, Luke Hill, Partner and Co-Founder at Cyber Alchemy, discussed how businesses can navigate uncertainty around cybersecurity and build maturity through clear, actionable roadmaps. He introduced the concept of the fractional CISO as a way for firms to define robust security strategies and highlighted the Alchemy Navigator tool, designed to help prioritise and manage cyber actions effectively. Luke urged organisations to view IT as a strategic investment rather than a cost, addressing common misconceptions and reinforcing the importance of trusted third parties in achieving long-term resilience.

Next, Sateesh Ramoutar, CCO, and Dr Peter Ashall, CEO of Easology, joined Jenny Halford, Sector Development (FinTech & Digital) at Business Durham, to share how Easology is empowering older and digitally excluded individuals through accessible FinTech and healthtech solutions. The company’s bespoke apps enable users to manage finances, make payments, and feel secure online, supported by partnerships with Samsung, EE, and Currys. Sateesh and Peter reflected on Easology’s decision to relocate to Durham, citing strong community support, recruitment opportunities, and grant backing as key to their growth and successful integration into the Northern FinTech ecosystem.

FinTech Showcase

Following the fireside chat was a FinTech North community favourite – the FinTech Showcase, expertly moderated by Rachel Swann, Founder of Rachel Swann Advisory Ltd. The session featured three innovative businesses showcasing how technology continues to drive positive change across the financial services landscape.

Charles Knight, Head of Sales – UK at SideUp, introduced the Brazilian-founded company’s UK expansion and its mission to make employee benefits smarter, more meaningful, and more cost-efficient. SideUp’s all-in-one platform helps businesses manage a wide range of employee benefits – from essential bills and commuting support to wellness, insurance, and learning opportunities – simplifying access and enhancing value for employees.

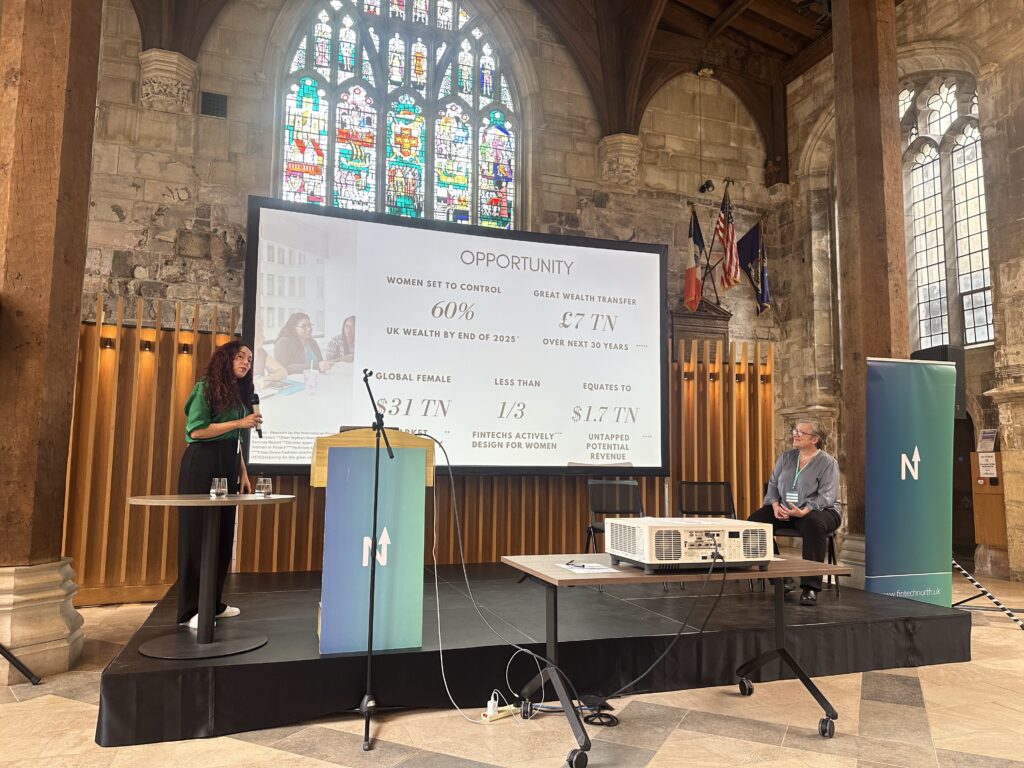

Suz Ferreira, Founder of Proper Financial Coaching, shared insights into the gender wealth gap across savings, pay, ISAs, and pensions, while highlighting the significant opportunity within women’s wealth. She emphasised the vital role of women’s wealth-building in driving generational prosperity, financial wellbeing, and broader societal change. Suz also discussed the development of her upcoming app, designed to make financial education, coaching, and empowerment more accessible and impactful for women.

Andrew Rabbitt, CEO and Co-founder of incuto, presented the company’s mission-driven technology platform that enables credit unions and community lenders to digitise services, automate loan processes, and offer modern payments infrastructure. With a strong focus on financial inclusion, Andrew highlighted how incuto helps tackle the “poverty premium” and ensures fairer, more affordable access to financial services.

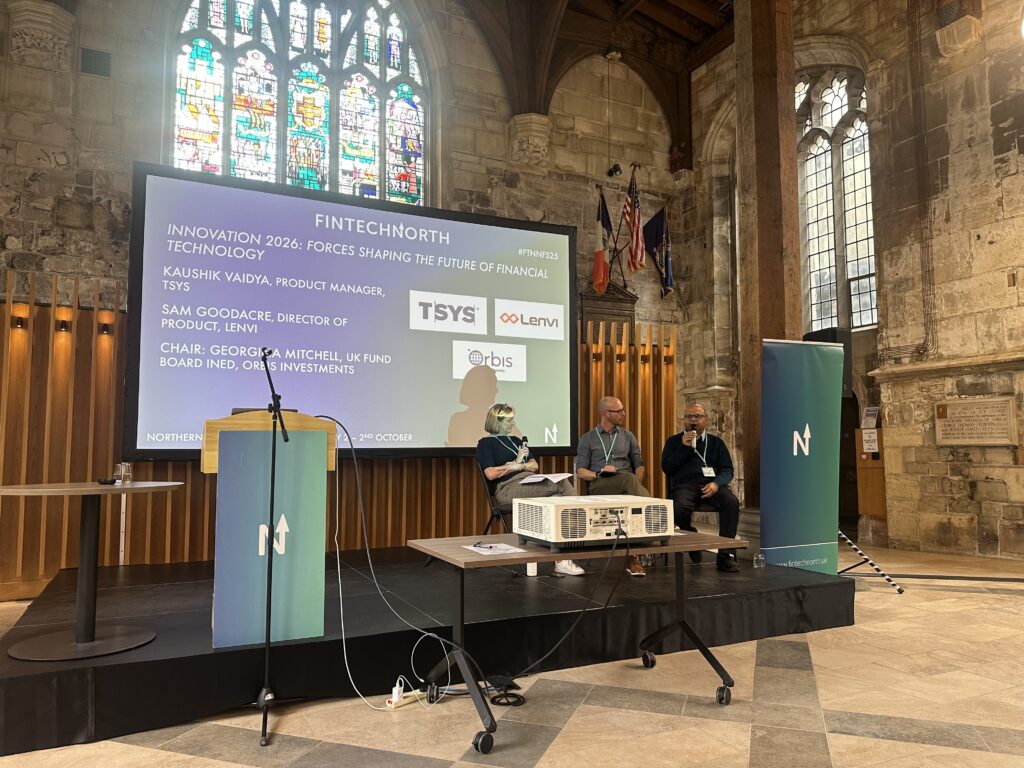

Forces Driving the Future of FinTech

Moderated by Georgina Mitchell, UK Fund Board iNED at Orbis Investments UK, the final panel featured Sam Goodacre, Director of Product at Lenvi, and Kaushik Vaidya, Product Manager at TSYS, exploring the forces shaping fintech innovation over the coming years.

The discussion covered the rapid rise of AI, emphasising the need to align solutions with real customer problems, avoid hype-driven adoption, and focus on efficiency in low materiality areas. Responsible AI, including model governance, bias mitigation, and explainable AI, was highlighted as essential for C-suite strategy. The panel also addressed financial inclusion, exploring how innovation and open banking can reduce exclusion and better serve underbanked communities.

Other topics included the role of cybercrime and fraud in driving innovation, the environmental impact of AI, and the need to balance energy consumption with technological progress. Talent and skills were highlighted as critical for deploying new technologies, alongside strategic alignment to ensure AI delivers value. Finally, the panel discussed quantum computing as a complementary force that will shape secure, next-generation financial services.

Day 2 of the Northern FinTech Summit showcased the breadth and depth of innovation, investment, and collaboration driving the sector across the North. From exploring the latest financial insights and investment strategies to highlighting cutting-edge technology, AI, and cybersecurity solutions, delegates gained a forward-looking perspective on the forces shaping the industry.

The day emphasised the importance of diversity, inclusion, and responsible innovation, demonstrating how fintech can deliver both commercial growth and positive societal impact. With inspiring case studies, engaging panel discussions, and opportunities to connect with peers and partners, Day 2 reinforced the strength, resilience, and momentum of the Northern fintech community, setting the stage for continued growth and innovation in the years ahead.

Thank You!

Thank you again to our community for attending, our speakers for sharing their insights and to our sponsors, Barclays Eagle Labs, Aviva, Cyber Alchemy, and Lenvi. With thanks to our namebadge sponsors, Incuto, and our inward investment partners West Yorkshire Combined Authority, Invest Liverpool City Region, North East Combined Authority and MIDAS – Manchester’s Inward Investment Agency.

For more information about opportunities for collaboration, reach out to us at info@fintechnorth.uk.