Write-up and Rewatch: The Future of Savings 12/11

On Friday 12th November the northern FinTech community came together virtually to explore the direction of travel for the savings market.

The Future of Savings was hosted in partnership with savings management and technology platform Newcastle Strategic Solutions.

As ever, we have produced a write-up and recording of the event, for those who were unable to join the event live. We recommend anyone with an interest in FinTech or the Savings market catch-up on this event, as there was some fantastic insight shared by our expert speakers.

If you wish to view the recording of the event, click the image below or alternatively, continue to scroll down to read our write-up.

Joe Roche, Engagement Manager at FinTech North welcomed attendees and provided an overview of the work that FinTech North does in the ecosystem. Joe also gave attendees an idea of what FinTech activity is going on across the North.

Julian Wells, Director of Whitecap Consulting and FinTech North then took the stage and proceeded to chair the event, introducing Steven Marks from Newcastle Strategic Solutions.

Steven provided an overview of NSS’s offering, which includes 13 live clients and over 1.2 million customer accounts.

NSS are seeing several themes emerge over the last few months:

- Levels of household savings have grown strongly over the pandemic – £1.67 trillion

- New providers entering the market; Bank North, GB Bank

- Savings providers and FinTechs’ continuing to grow

- Competition intensifying – 119 active providers > now 131

- Customers have increased expectations – Digital

- 1/3rd of adults have a banking app or online tool of some kind

- Environmental products; Green Savings products are on the rise

NSS are actively working with their customers to gain user insight on the needs of savers from their digital service. They have distilled those findings down:

- Clients want a fully digital journey, easy, fast, great digital exp

- 81% aged 55+

- 80% comfortable using tech

- 13% had concerns around security and sharing data under Open Finance

Future capabilities:

- Open Finance

- Biometrics

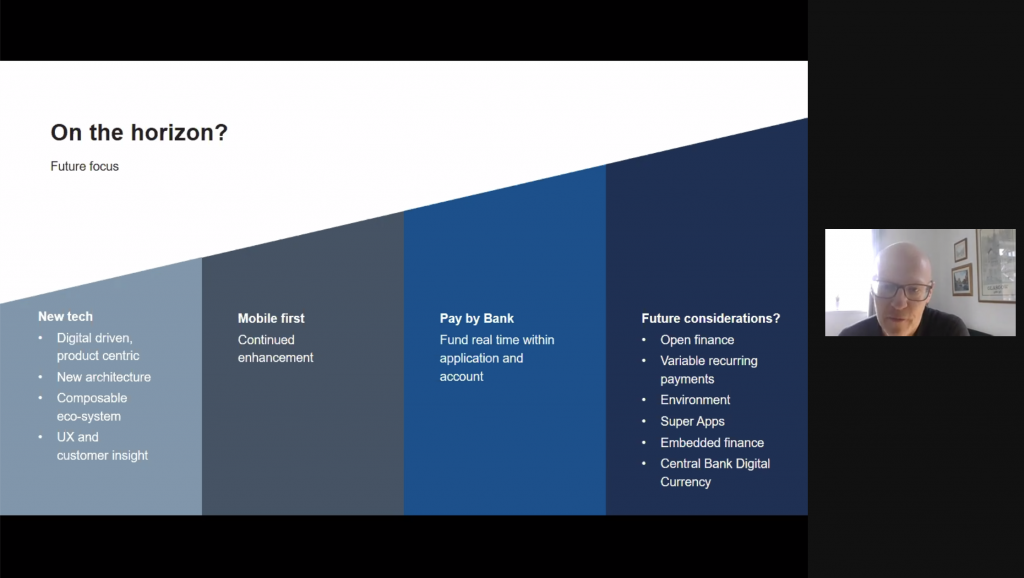

On the horizon?

- New Tech

- Mobile First

- Pay by bank

Future considerations:

- Variable recurring payments; seen as the industry standard mechanism to sweep excess funds into current accounts and savings accounts.

- Green products growing

- Growth of super apps

- Use of BNPL

- Central bank digital currency; HMT outlined pathway for development, potential for live launch in second half of the decade – could this one day extend to digital currency savings accounts?

- Development in savings products and services is coming thick and fast, consumers increasingly confident using them.

–

Rosalie Dowding, Product Manager at TrueLayer, was our next speaker. Rosalie provided some fantastic insight from her perspective, talking us through what’s changing in Open Banking and how it’s transforming people’s savings habits.

Open Banking encourages banks and providers to develop innovative services to benefit the consumer.

“It’s making online payments really work… the growth we’ve seen in the last year has been astronomical”

“No payment method available in the market is entirely fit for purpose”

The benefits of Open Banking Payments:

- Higher conversion

- Fraud lessened, stronger authentication & biometrics

- Settlements are instant, faster payments rails

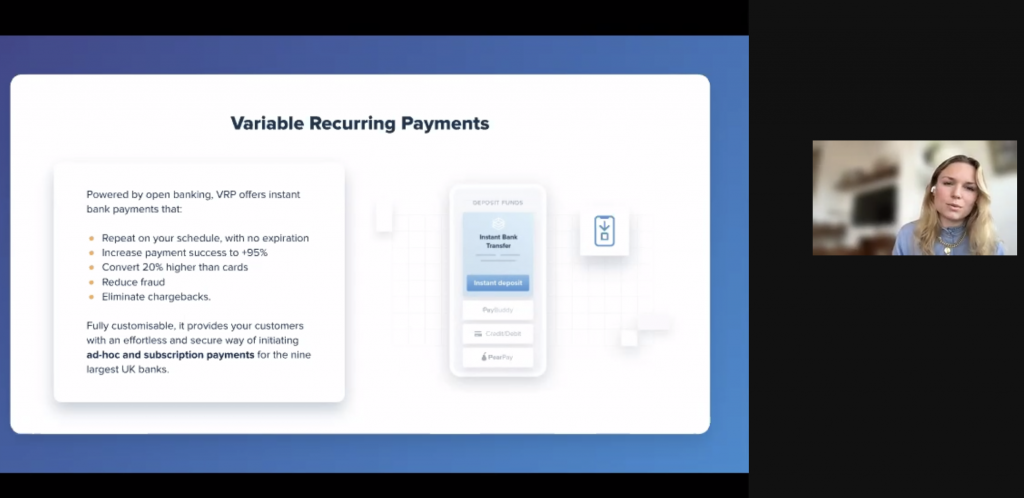

Rosalie illustrated how ‘Sweeping’, variable recurring payments, happen automatically to maximise the use of a customer’s assets.

Beyond 2022, Variable Recurring Payments can be used in other settings, e.g. checkouts by retailers. “We believe this is going to kill cards.”

“This use-case is a game-changer for anyone who finds savings hard or boring!”

–

Our next speaker was Nebula Norman, Head of UK Marketing for Manchester based FinTech, Raisin.

Nebula gave an overview of Raisin’s story, with both DS and Raisin combining as Raisin DS – a pioneering and award winning FinTech providing Open Banking Infrastructure.

Nebula spoke about trends as Raisin see them:

- 52% of households have managed to increase their savings

- Consumers are now spending more, retail spends are up

- Interest rates were kept low because BoE want people to spend even more

- Rate apathy – despite increases in savings, many people left their money in high-street savings accounts

Savings disrupted:

- Increased role for savings aggregators

- Good for savings providers, customer expectations higher

- Apathy or education?

- Putting the tech into Fin

“Relevancy is supremacy” – Nebula Norman, Head of UK Marketing, Raisin UK

“If you aren’t relevant, consumers will stop using your services… it’s really important to maintain relevancy throughout your services… you might be a hit now, but if you want to stay relevant, you’ve got to move with the times”.

What’s important to the next generation?

- Sustainability

- Ethical banking – launched Reliance Bank – searches for ethical and environmental savings have recently seen growth of %100+

- Cryptos – what started as a fad is now worth a huge amount, and it’s growing exponentially.

–

Will Stevens, Partner in Digital Banking Platforms business at PwC, was our next speaker. Will does most of his work bringing new propositions to market, so shared that insight with the community.

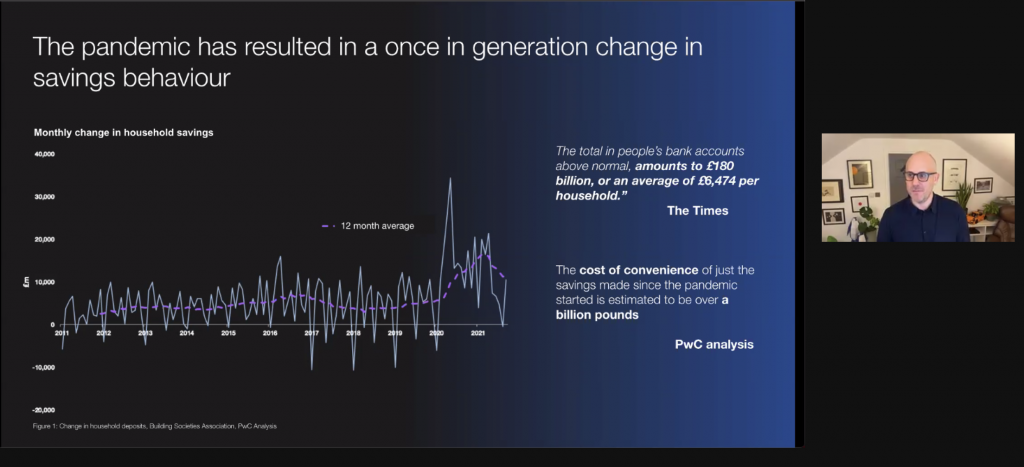

“Last year saw the biggest shift in savings behaviour in a generation… we’ve seen that behaviour sustained…”

“Most savings have gone into easy access, short term savings accounts”

£200bn in excess savings // £1bn in lost interest for consumers = cost of convenience.

PwC split the market into 3:

- Established savers, probably older consumers, willing to shop around for the best rate

- Rainy day saver – significant increase during the pandemic, broad spectrum from age perspective

- Goal oriented saver – younger savers, seeking to shift savings behaviour – 1 in 5 of Gen Z and millennials

Shift in trust from banking brands to embedded brands, embedded finance, personalised journey and experience, rise of the influencer = accelerating change and shifting behaviour.

“If you forecast on the latest Open Banking numbers, from 5.5% adoption in Dec 2020, around now we’re crossing the threshold of 10% adoption, which we think is a tipping point.”

- ¾ of people using Open Banking say they would continue to use services.

- 9/10 people say it’s easy to use.

- 83% said they would expand their use of OB services.

- 2/3rds of people using OB powered savings proposition said that OB had increased their level of savings – this can only be a good thing

–

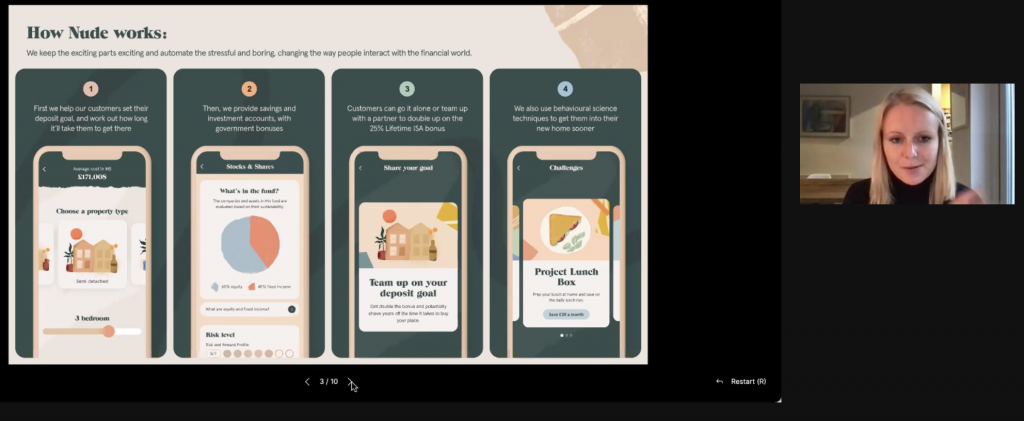

Antonia Lock, Head of Strategic Initiatives, was our next speaker. NUDE are helping customers save for their first home deposit and build good money habits.

Launching earlier this year, NUDE are on a mission to make the financial system fairer, easier and more transparent for young people.

Nude offer a Lifetime ISA product, where for every contribution up to £4,000 each year the government will top it up by 25%, so you could get £1,000 free towards your first home each tax year. With Nude you can save in cash or invest in a sustainable fund, during the session we focussed on the cash savings option.

Nude uses behavioural science techniques to help people get into their home sooner, recommending budgeting areas for example cutting down on online takeaways, coffees or subscriptions.

NUDE have gamified this journey, with a tool that allows them to effect their time to buy… and the challenge to save for their first home. This helps users see the impact of small changes to spending habits.

“The key to savings and building good habits is testing things… try what works for you” – Antonia Lock, Head of Strategic Initiatives, NUDE

–

Panel discussion

We introduced two new speakers to the panel, Taya Allen & Stewart Bromley. Taya is Head of Digital at NSS. Stewart Bromley is CTO at Northern Challenger Bank Atom Bank.

“There’s more choice than ever for consumers, which is only a good thing…the ease of opening accounts and making money work for you has never been better” – Stewart Bromley, CTO, Atom Bank

“We have the ability to launch new apps and services every week – this gives you an advantage because you can listen to your customers and respond in a timely way… We’re not mobile first, we’re mobile only… this is a significant security play – if you’re app based, we tie you and your device together, giving only one access point to your account.” – Stewart Bromley, CTO, Atom Bank

“How do we start to make the savings process ubiquitous within people’s everyday lives?” – Taya Allen, Head of Digital, NSS

Q – How could VRP kill card payments?

“Once we introduce recurring payments, we’re delivering extra value to the customer, instead of having to remember your details, you just pay into a wallet you have with that merchant, strongly authenticate once, you have one-click checkouts, you confirm the amounts are in and you’re done.” – Rosalie Dowding, Product Manager, TrueLayer

“Complete customer transparency, it’s all traceable, smoother Xu and lower cost to the merchant, a longer life-span on bank accounts. It’s stripping out a lot of friction that we have with cards today.” – Rosalie Dowding, Product Manager, TrueLayer

“Balance between Brand trust and optimising the financial position”– Julian Wells, Director of WhiteCap Consulting

“When we talk about tech and solutions, it’s easy to be overwhelmed by that; sometimes it’s important to strip it back to what the UK saver wants or needs with this.” – Taya Allen, Head of Digital, Newcastle Strategic Solutions

“There’s also an angle to make it fun and engaging, if adding complexity makes it fun, then maybe that’s interesting for customers” – Julian Wells, Director of WhiteCap Consulting

“Broadly, yes, you want to make things easier but a bit of positive friction every now and then can help inform decisions.” – Antonia Lock, Head of Strategic Initiatives at NUDE

“Gamification for an individual is brilliant, but if you can extend that out to a family or community then we’re starting to see some really interesting dynamics. Gamification can be applied here in a group setting not just solo” – Will Stevens, Partner in Digital Banking Platforms business at PwC

–

Once again, a big thank-you to our speakers for sharing their insight and to everybody who joined us live or those reading through our write-up.

Our next event is our first physical conference since 2019, hosted at the Whitworth Hall in Manchester. More information can be found via our website here.